Rates

Let your money do the work for you with great rates.

Let your money do the work for you with great rates.

There's more to a credit union than just banking.

We know that strong financial literacy is key to making informed decisions about money.

We offer industry leading business account rates.

Connect with our Business Banking team

Located at 1 James Street South in Hamilton.

Meet our Wealth Team

Our wealth advisors are here to provide expert guidance and support.

We know that strong financial literacy is key to making informed decisions about money.

We know that strong financial literacy is key to making informed decisions about money.

A budget is a roadmap for managing finances, ensuring income and expenses are separated and balanced effectively. By tracking your spending, setting clear goals and creating a realistic budget, you can make informed financial decisions, reduce debt and build savings.

The primary components of a budget include:

Putting money into assets with the potential to grow and generate returns over time.

More income than expenses means you have a surplus. When expenses exceed your income, you have a deficit.

The timeframe for your budget could be monthly, quarterly or annually.

Look at your current financial situation. Gather your financial documents, including bank statements, credit card bills, utility bills and any other sources of income and expenses. Note your total monthly income and your regular monthly expenses.

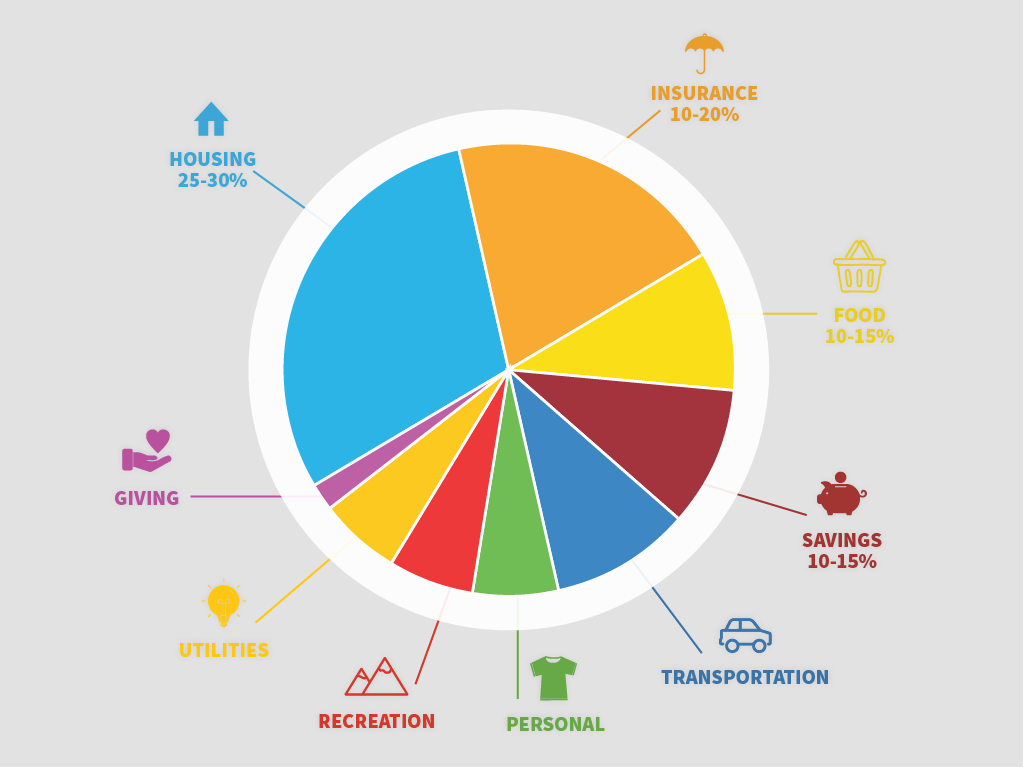

You need to know where your money is going. Track your expenses for a month to understand your spending habits with a pen and paper, spreadsheet or budgeting app. Categorize spending into essential categories like housing, groceries, transportation, utilities and discretionary items.

Define short-term goals that include an emergency fund or paying off high-interest debts and long-term goals that involve saving for a home, retirement or education. Clear objectives will help prioritize spending and ensure your budget aligns with your financial aspirations.

When you have a comprehensive understanding of your finances and goals, create your budget. List sources of income and allocate funds to each expense category based on your spending habits and financial priorities. If your expenses are higher than your income, review your discretionary spending and look for ways to cut back.

Allocate 50% of your income to essential expenses (like housing, groceries, utilities, debt payments). Reserve 30% for discretionary spending, including entertainment, dining out and non-essential purchases. Dedicate the remaining 20% to savings and investments to build a secure financial future.

It's crucial to be realistic about your money. Avoid overestimating your income or underestimating your spending – this could make it harder to stick to your budget. Life is unpredictable and your financial situation may change. Stay flexible and adjust your budget when you need to.

Monitor your spending regularly and compare it with your budgeted amounts. Review your progress and make adjustments as you go. This will help you stay on track and identify areas for improvement.

Budgeting tip!

It should also include long-term goals like buying a house, post-secondary education, starting a business or saving for retirement. Allocate funds toward these goals to make steady progress. Get direct access to our wealth advisors through FirstOntario Wealth Connect.

Give us a call at 1-800-616-8878 or visit your local branch.

Privacy and security • Legal • Accessibility statement • Market Conduct Code • View all online policies • Site map

FirstOntario Credit Union © Copyright 2025